Pioneering TPH implementation, ITSS has built a center of expertise, globally!

Geneva, June 01, 2021 – ITSS is on the path of becoming the global leader in TPH implementation, thanks to the wealth of experience accumulated, by effectively supporting financial institutions across the world to seamlessly migrate from FT to TPH. With 8 successfully completed TPH implementation projects, and 9 still on-going projects, ITSS is leaving it’s footprints globally.

Why TPH? Payments are central to every business as they constitute the true lifeblood of any financial organization. Today’s market environment highlights the need for banks to quickly adapt their payments strategies to support changing market conditions and business needs.

The global lockdown has definitively reshaped how we function as a universal workforce. Among the many positive examples of how technology has enabled us to work and socialize remotely, it has also served to throw light on payments services provided by banks, which don’t quite live up to the standards set by other parts of our increasingly digital society.

Statista has estimated that the total transaction value in the digital payments segment is growing at an annual growth rate of 12%. As payments processing volumes are growing with increasing diversity of customer demands, the areas such as digital payments modes, real-time payments, fraud monitoring and many aspects of processing are put under severe pressure within a bank’s functional system.

With global payments infrastructure moving to a single messaging standard, ISO 20022, the shift is not purely a compliance exercise. The reality is that this new standard has far-reaching and highly strategic implications for most banks and financial institutions. An agile payments solution that offers real-time processing and open APIs as core requirements, have become vital for financial institutions.

Adoption of TPH (Temenos payment Hub) will now allow banks to offer their customers a seamless payment experience which offers straight through processing (STP) and provides a 360° view of all transactions in real-time and have a workflow for priority based payments processing.

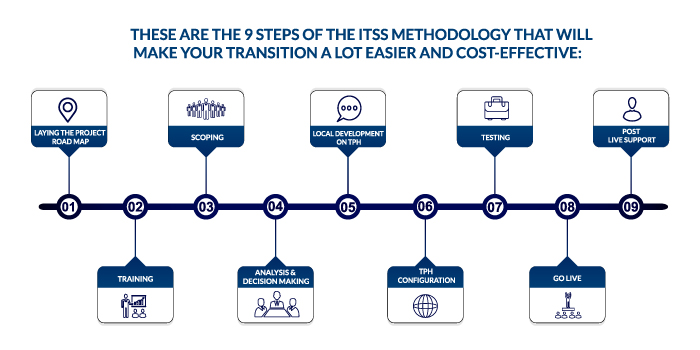

Why choose ITSS? With over 20 years of experience of successfully delivering banking solutions globally, ITSS has accumulated a nuanced understanding of the needs and requirements of Temenos’ clients throughout the globe, and has developed a proven best practices on TPH (Temenos Payment Hub) implementation. Thus effectively establishing regional implementation hubs that can guarantee a smooth transition from FT to TPH, that enables financial institutions to unlock the value-adding opportunities that they have been chasing for years.

TPH can also work as a stand-alone requirement, and ITSS is ready to assist financial institutions across the world optimize their current Temenos fund transfer core module.

ITSS offerings while leveraging TPH are designed to work successfully both separately or together, via SaaS, cloud, or on-premise, providing the flexibility to tailor payment solutions to suit simple, complex and diverse needs.

Contact us today! We can guide your Payments Modernization Process and help you future proof your business with Temenos payment hub : mail@itssglobal.com